In today’s competitive business environment, growth alone is not enough. Many businesses generate high revenue but still struggle to survive. The real reason behind this failure is poor profitability at the unit level. This is where business unit economics becomes critical.

Understanding unit economics helps founders, startups, and business owners answer one fundamental question:

Is my business actually making money per unit sold?

This guide on Understanding Business Unit Economics: What Is Unit Economics Formula will explain the concept step by step, using simple language, real examples, and practical formulas. Whether you are running a startup, SaaS company, eCommerce brand, or service-based business, unit economics will define your long-term success.

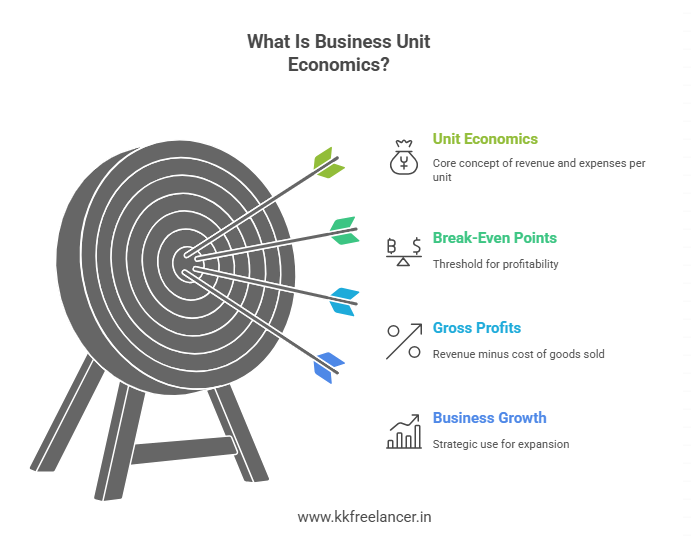

What Is Business Unit Economics?

Unit economics is the actual revenues and expenses of a specific company, calculated by unit, which can refer to any item that can be quantifiable and adds worth to the business. Unit economics calculations make it simpler to plan things like break-even points as well as gross profits. Many businesses are at a minimum degree, making use of unit economics calculations even if they’re unfamiliar with the concept. However, fully utilizing the unit economics of your business requires some more dedication and knowledge.

Examples of a unit:

- One product sold (eCommerce)

- One customer (SaaS)

- One order (Marketplace)

- One service booking (Service business)

Unit economics focuses on two key components:

- Revenue per unit

- Cost per unit

When revenue per unit is higher than cost per unit, the business is sustainable. When costs exceed revenue, scaling only increases losses.

In simple terms, unit economics answers:

“Do I make money every time I sell one unit?”

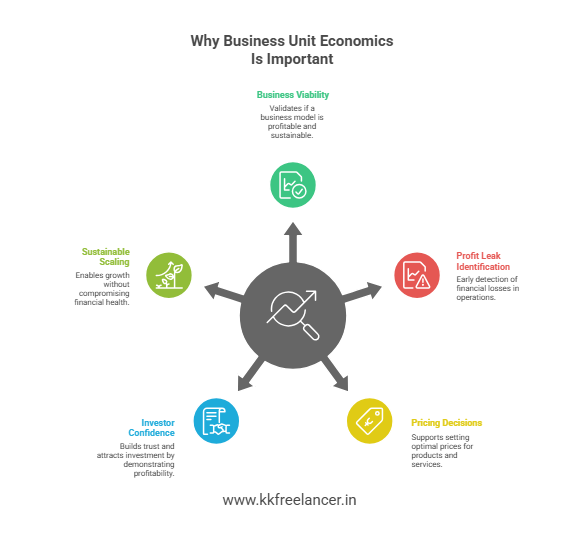

Why Business Unit Economics Is Important

The economics of business units are important because it reveals the numbers clearly how a business actually earns profit on every sale, customer, service, or unit, and not just on paper but actually in daily activities. It breaks down the business to its most basic workable component and addresses the fundamental questions that define the company’s future: how much it will cost to acquire customers, the amount of the customer’s revenue generated in the long run, as well as what margin is left after providing them with. Without this information growth can be a bit untrue. Businesses can increase their revenues quickly, but still lose cash on each unit sold, leading to an increase in cash flow, and then abrupt failure. A strong unit economics system helps entrepreneurs and managers price items correctly, manage costs, and determine where to put money into or reduce. It also assists in identifying issues earlier, like growing costs of acquisition or shrinking margins, before they develop into massive losses. For lenders and investors Unit economics helps build trust since it shows that growing the business can increase profits rather than multiplying losses. For teams, it provides an environment of clarity by aligning marketing operational, sales, and other departments on profitable decisions rather than merely superficial metrics. In the simplest terms, business unit economics is a financial reality checker, helping to make better choices, sustainable growth and long-term stability, instead of growth that appears attractive but is not financially sustainable..

Read More – All About B2B Sales Ecosystem

Importance of unit economics:

- Helps validate business viability

- Identifies profit leaks early

- Supports better pricing decisions

- Improves investor confidence

- Enables sustainable scaling

Investors often reject startups with weak unit economics, even if revenue growth looks impressive.

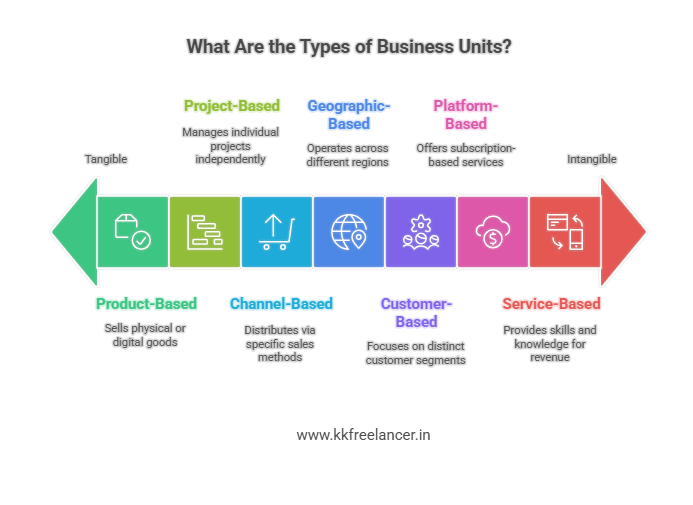

What Are the Types of Business Units?

Different businesses define “units” differently. Understanding the types of business units is essential before calculating unit economics.

- Product-Based Business Unit

This unit is focused on the selling of digital or physical products. Every product or line is considered to be an individual unit, with distinct prices, costs and tracking of profit. Examples include electronic devices packaging, packaged goods, software licenses, and manufactured products. The objective is to know how much profit each item produces after manufacturing marketing, distribution, and expenses.

- Service-Based Business Unit

This unit earns revenue by offering services rather than products. The amount of revenue earned is contingent on the amount of time, skills or knowledge. Examples of this include consulting, maintenance training, digital marketing as well as IT assistance. In this case, unit economics typically is based on the cost for an hour or per employee, usage and billing rates for clients.

- customer-based business unit

In such a business the business is divided by groups of customers rather than services or products. For instance, enterprise clients, small business, individuals may be considered as distinct entities. This can help companies determine which segment of customers has the highest longevity and value, and which is more expensive to serve.

- Geographic Business Unit

Companies with several locations typically establish business units that are based on countries or regions. Each region is a distinct unit that has its own revenues goals as well as operating costs and performance metrics. This arrangement helps to manage prices, demand, and costs that differ by region.

- channel-based business Unit

This model is built on the method by which goods or services get offered for sale. Some examples include sales via online retailers, distributors, retail stores and direct sales team. Each channel has its own cost as well as profit margins therefore monitoring them separately can help determine which channels are worthwhile to expand.

- A Project-Based Business Unit

Commonly used in media, construction IT, as well as consulting firms, this unit considers each project as an independent business unit. Profit is calculated by comparing revenue from projects against tools, labor and overhead costs. This allows you to determine which kinds of projects will yield the most profit.

- platform or subscription-based business Unit

Used in SaaS and subscription companies The unit focuses on periodic revenue models. Measurements like the cost of acquisition for customers as well as monthly recurring revenue, lifetime value, and churn are used to define the level of its performance. The emphasis is on long-term profit instead of one-time sales.

Unit example:

One service booking or project

Unit Economics for Startup With an Example

For a start-up, unit economics involves figuring out how much the company makes or loses on a particular unit of the products it sells. The term “unit” can refer to any of the following “unit” could be a single customer, an order, one subscription, or a single product, based upon the model of business. This is a crucial concept for startup companies because growth in the beginning often conceals issues. Revenue might be growing however if each unit is more expensive to purchase and maintain than it is worth the company will be accumulating losses on a large scale.

At the heart of unit economics for startups are a couple of simple numbers. The Customer Acquisition Cost (CAC) shows how the startup is spending to get a customer by sales and marketing. Revenue Per Unit (or average revenue per user (ARPU) shows how much money the customer is bringing to. Gross Margin will show how much is left after the direct costs such as production, hosting delivery, or support. Lifetime Value (LTV) estimates the total amount of profit that a customer earns during their time with the business. If a company wants to be sound, LTV must be higher than CAC and the payback period must be long enough to ensure cash flow.

A strong unit economics foundation helps entrepreneurs decide on pricing, select the appropriate channels for marketing, and decide when to expand. If unit economics aren’t strong growth will only increase the risk of losing money and makes fundraising more difficult. Investors pay attention to these numbers to determine the likelihood of growth leading to a profit or a decline. For entrepreneurs the unit economics act as a check on the reality of their business. It shifts the focus away from a few arbitrary metrics such as downloads or users’ totals to the most important thing is creating a business that makes more money from each unit than it pays for. In simple terms, unit economics is what transforms a concept for a start-up into a profitable business.

.

Startup Example (Simple):

Let’s say a startup sells an online course.

Revenue per unit:

- Course price = ₹2,000

Costs per unit:

- Marketing cost per sale = ₹700

- Platform fees = ₹200

- Customer support = ₹100

Total cost per unit = ₹1,000

Unit Economics Calculation:

- Revenue per unit = ₹2,000

- Cost per unit = ₹1,000

Profit per unit = ₹1,000

This startup has positive unit economics, meaning each sale generates profit.

If the cost per unit was ₹2,200, scaling would lead to losses.

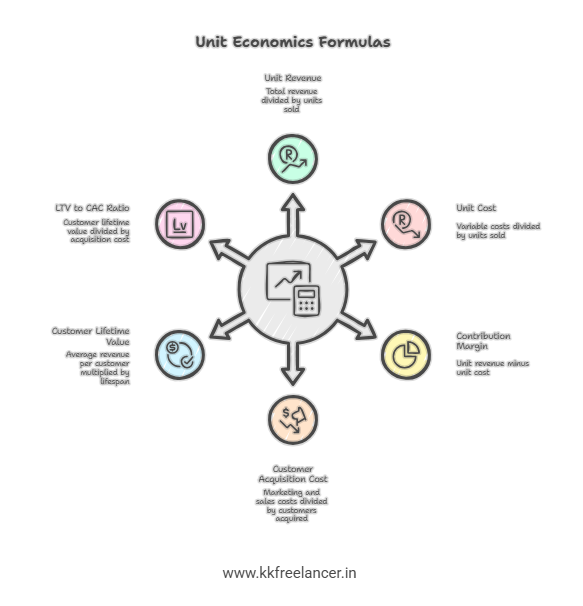

Unit Economics Formulas (Core Metrics Explained)

Understanding formulas is the backbone of unit economics analysis.

1. Unit Revenue Formula

Unit Revenue = Total Revenue ÷ Number of Units Sold

2. Unit Cost Formula

Unit Cost = Total Variable Costs ÷ Number of Units Sold

Variable costs include:

- Marketing

- Logistics

- Payment gateway fees

- Customer support

3. Contribution Margin

Contribution Margin = Unit Revenue − Unit Cost

A positive contribution margin indicates profitability.

4. Customer Acquisition Cost (CAC)

CAC = Total Marketing & Sales Cost ÷ Number of Customers Acquired

5. Customer Lifetime Value (LTV)

LTV = Average Revenue per Customer × Customer Lifespan

6. LTV to CAC Ratio

LTV : CAC = Customer Lifetime Value ÷ Customer Acquisition Cost

A healthy business typically has:

- LTV : CAC ≥ 3:1

How to Calculate Unit Economics for Your Business

Follow this step-by-step framework to calculate unit economics accurately.

Step 1: Define Your Unit

Decide what a “unit” means in your business:

- One product

- One customer

- One order

Step 2: Calculate Revenue Per Unit

Include:

- Selling price

- Subscription revenue

- Add-ons

Step 3: Identify Variable Costs

Include only costs that increase with volume:

- Ads & promotions

- Packaging & delivery

- Platform or software costs

Exclude fixed costs like rent and salaries.

Step 4: Calculate Contribution Margin

Subtract unit cost from unit revenue.

Step 5: Analyze Profitability

- Positive margin → scalable business

- Negative margin → fix pricing or costs

Common Mistakes in Unit Economics Calculation

Many businesses calculate unit economics incorrectly.

Mistakes to avoid:

- Including fixed costs

- Ignoring marketing expenses

- Overestimating customer lifetime

- Using averages incorrectly

- Not updating data regularly

Accurate unit economics requires continuous monitoring.

How Unit Economics Helps in Business Growth

Unit economics can help businesses grow by revealing whether the growth is beneficial or detrimental. It analyzes costs and revenue at the most minimal level of workable that is, for instance, by customer per purchase or per product. It also clarifies the amount of profits each unit makes. If a company is aware of this, it can pinpoint the factors that drive profit, and also the factors that drain cash. This helps managers determine the best rates, control direct expenses, and choose marketing channels that attract lucrative customers instead of costly low-value customers.

As businesses grow as it expands, inefficiencies that are small can multiply. Unit economics can reveal these problems early by monitoring metrics like customer acquisition costs and life-time value, gross margin and payback time. If these numbers rise as they grow, the growth will become more stable and less unpredictable. If they increase the company is given an alert before losses begin to spiral beyond control. This information helps teams decide the best time to accelerate their growth or stop, and when to repair this model initially.

Unit economics also helps make better investment choices. Businesses can invest with confidence in marketing, sales hiring, expansion, or hiring knowing that each unit will yield a profit. For lenders and investors the strong economics of unit economies indicate that growth is likely to boost value, not increase risk. In simple words, unit economics transforms growth from speculation to a controlled procedure aiding businesses to grow steadily to protect cash flow and create the long-term stability of their business instead of trying to chase growth that appears to be huge but doesn’t work financially.

- Scale confidently

- Increase marketing spend safely

- Improve pricing strategies

- Attract investors

- Improve cash flow planning

Without strong unit economics, growth becomes risky.

Role of Experts in Unit Economics Strategy

Unit economics becomes complex as businesses grow. Advanced analysis requires experience and data-driven insights.

Working with a business strategy expert helps:

- Optimize pricing models

- Improve customer acquisition efficiency

- Increase lifetime value

- Reduce operational waste

kkfreelancer helps startups and growing businesses understand, calculate, and optimize unit economics for sustainable growth.

Unit Economics vs Overall Profitability

Many businesses confuse unit economics with overall profitability.

| Aspect | Unit Economics | Overall Profit |

| Focus | Single unit | Entire business |

| Helps decide | Scalability | Financial health |

| Timeframe | Short-term | Long-term |

| Use case | Growth decisions | Accounting |

Both are important, but unit economics drives smart scaling.

Real-World Use Cases of Unit Economics

- Startups: Validate business models

- SaaS companies: Optimize subscription pricing

- Ecommerce brands: Reduce logistics costs

- Agencies: Improve project profitability

Every successful business tracks unit economics consistently.

Conclusion

Understanding business unit economics is not optional—it is essential. Businesses that focus on growth without strong unit economics risk failure, no matter how popular their product is.This guide on Understanding Business Unit Economics: What Is Unit Economics Formula gives you a clear framework to analyze profitability, improve decision-making, and scale sustainably.

Frequently Asked Questions

Unit economics measures profit or loss per unit sold.

It ensures startups don’t scale losses and remain sustainable.

A healthy ratio is typically 3:1 or higher.

Yes, service-based businesses use project or booking as a unit.

Yes, kkfreelancer provides strategic guidance for unit economics optimization.